Why a mobile Wallet ?

Approx. 50% of population in LATAM, is unbanked or under banked.

Millons dollars in cash are used daily in commercial transactions like:

- Merchant payments. Goods and Services.

- Bill payment (energy, gas, water, cable TV, etc).

- Personal payments.

- Airtime top Up.

- And many more...In other ocassion we can talk about Mobile B2B, G2C and other possibilities for financial institutions.

But today are the banks looking for to get a share in this market, seriously ?

What happen with TELCOs ? What happen with Brands ?

TELCOs are working this market seriously, becuase they need to increase their ARPU, and they know how to reach these customers trought their POS network, to sale Airtime top up.

Are the banks already prepared to compete with WANDA the Mobile Wallet of Telefonica and Mastercard in 26 countries ?

VISA it is selling Stored Value Accounts (Pre Paid cards), I means Saving Accounts.

What happen with their tradicional partners, the Banks.? This is competition ?

Then we ask, what should do the Financial Industry ? I means Banks, Acquirers, ACHs, and other players.

They should take advantage of Banked population, they are also target, because mobile payment has tangible benefits to the customer, make sense by

- Security. 2FA, Login, PIN.

- Comfort.

- Fashion. Is cool.

- Improve personal Finance, giving control about expenses.

- As a way to manage your Bank Accounts from your Mobile Phone.

The mobile channel is a perfect way to introduce new business lines and to create an space for new concepts in financial services, for instance:

- Domestic Remittances.

- Person to Person Payments. Collection between friends, Give money to their childs, etc.

- To be defined.....

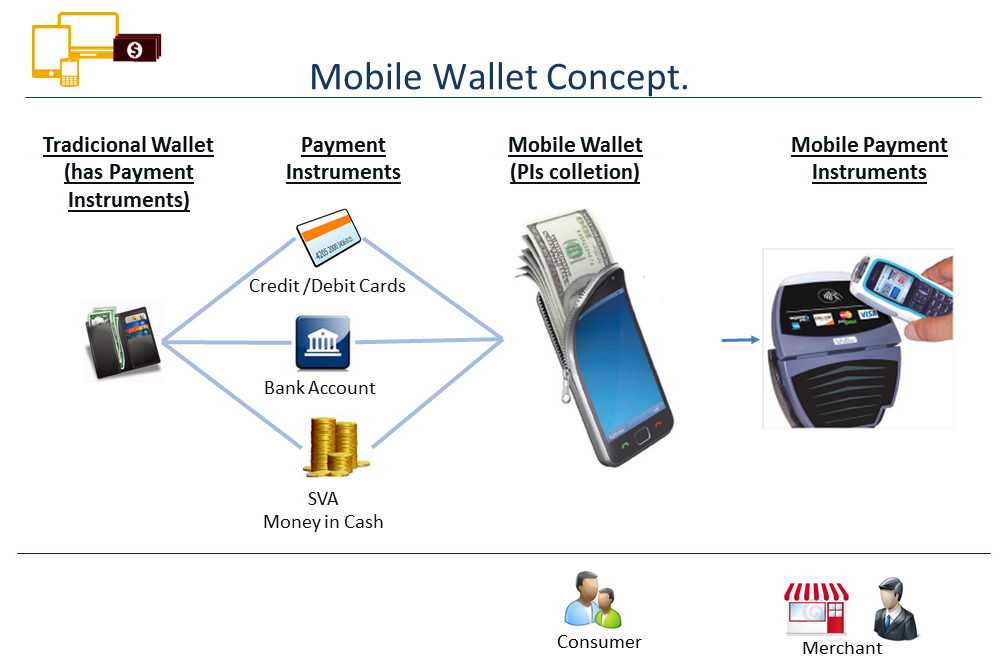

Mobile phones has the power to move cash money to the virtual world, and to transform each mobile phone in a POS to make financial transactions in a safe way, that means a Payment Instrument, Bank grade.

To be sucessful, the mobile channel should create an ecosystem where Banks, TELCOs, Merchants, and other players can coexist together to provide a financial service to the population.

It is not difficult to see clearly Acquirers as the best positioned players to issue a Mobile Wallet today, they have the infraestructure, banks and brands connections, and the Merchants network already running. Furthermore usually are property of the Banks in each country.

So... welcome to the future, where your mobile phone is the new personal computer and your new wallet for Cards and Virtual Cash, anytime, anywhere, always on and connected, its ubiquity is the trick.

What is a Mobile Wallet ? What is Mobile Banking ?

Next....

What is the cost for a financial institution to implement a new mobile channel ?

Saas is a choice ?

How long is needed to implement and integrate the mobile channel ?

How is the adoption curve for mobile banking and mobile wallets in the population ?

What is the ROI on Mobile Banking and Mobile Wallet ?

No comments:

Post a Comment